Refer to our Texas Go Math Grade 7 Answer Key Pdf to score good marks in the exams. Test yourself by practicing the problems from Texas Go Math Grade 7 Unit 7 Study Guide Review Answer Key.

Texas Go Math Grade 7 Unit 7 Study Guide Review Answer Key

Taxes, Interest, and Incentives

Texas Go Math Grade 7 Unit 7 Exercises Answer Key

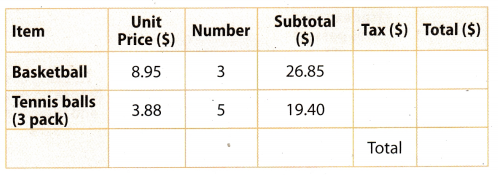

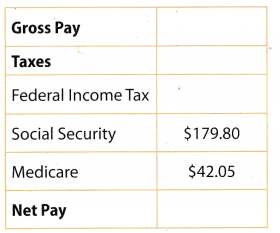

Question 1.

Find the sales tax for each product, using a sales tax rate of 8.5%. Then find the product’s total price and the total for the entire purchase. Round to the nearest hundredth. (Lesson 13.1)

Answer:

Total cost including taxes is $50.18

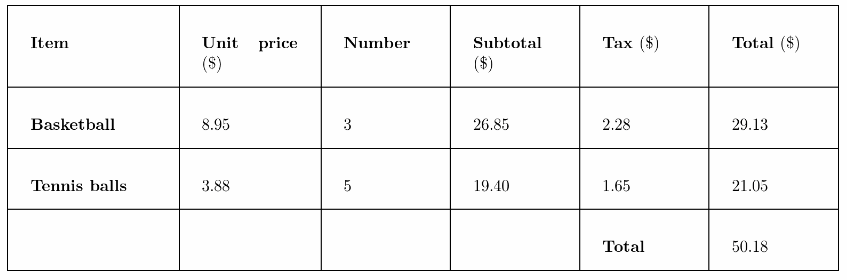

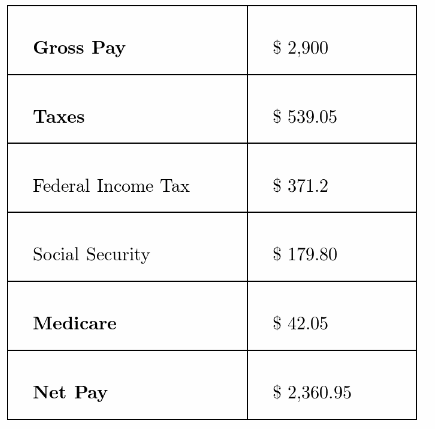

Question 2.

Claire earns a monthly paycheck of $2,900. Federal withholding is 12.8% of her gross pay. Complete the table. (Lesson 13.1)

Answer:

Net pay is $2,360.95

Question 3.

Bette has $10,000 to put into savings accounts. She puts half into an account that earns simple interest at an annual rate of 3.1%. She puts the other half into an account that earns interest at an annual rate of 2.6% compounded annually. After 10 years, which account will earn more money? How much more? (Lesson I 3.2)

Answer:

Total amount of money that Bette have = $10, 000

Rate of simp[e interest for half money = 3.1%

Rate of compound interest for remaining half money = 2.6%

Time duration for which money is kept in bank account = 10 years

Simple interest of half money for 10 year = \(\frac{5,000 \times 3.1 \times 10}{100}\)

= \(\frac{155,000}{100}\)

= $1,550

Total amount = 5000 + 1550 = $6550

Compound interest of half money for 10 year = 5000(1 + 0.026)10

= 5000 × 1.29

Total amount = $6463.14

Difference in total amount after 10 years = 6550 – 6463.14 = $86.86

Hence, simple interest account will earn more money.

Question 4.

Barack can buy a four pack of mangos for $2.76 or a six pack of mangos for $4.32. Which is the better buy? Explain. (Lesson 13.3)

Answer:

Case 1

Cost of four pack of mangos = $2.76

Now we with find cost of pack = \(\frac{2.76}{4}\) = $0.69

Case 2

Cost of six pack of mangos = $4.32

Now we will find cost of 1 pack = \(\frac{4.32}{6}\) = $0.72

First case in which four pack of mango cost $2.76 will be better option for buying because the after calculating the cost of one pack in each case we can see that in first case it is lesser as compared to second case.

Hence, four pack of mango for $2.76 is better buy.

Planning Your Future

Example 1.

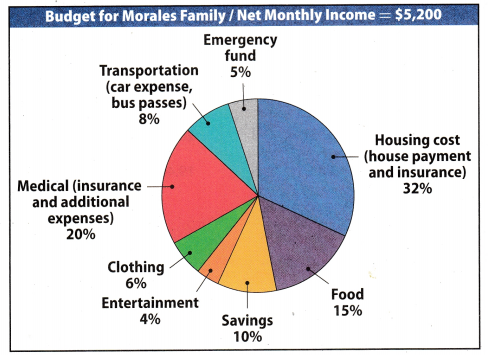

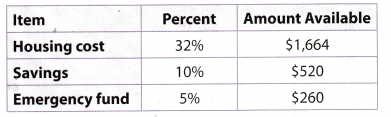

The circle graph shows the Morales family’s monthly budget. Their fixed expenses are housing, savings, and an emergency fund. Use the graph to find the amount the family spends on fixed expenses.

Exercises

For 1-3, use the graph from the Example. (Lesson 14.1)

Question 1.

How much money does the Morales family spend on clothing each month?

Answer:

Net monthly income of Morales’s family = $5,200

Percentage of budget used for clothing = 6%

Money spent monthly on clothing = \(\frac{\text { Percentage }}{100}\) × Net monthly income

= \(\frac{6}{100}\) × 5,200

= 0.06 × 5,200

= $312

Hence, Morales family spend $312 per month on clothing

Question 2.

How much more money does the Morales family spend on food than on entertainment?

Answer:

Net monthly income of Morales’s family = $5. 200

Percentage of budget used for Food = 15%

Percentage of budget used for Entertainment 4%

Money spent monthly on Food = \(\frac{\text { Percentage }}{100}\) × Net monthly income

= \(\frac{15}{100}\) × 5,200

= 0.25 × 5,200

= 0.15 × 5,200

= $780

Money spent monthly on Entertainment = \(\frac{\text { Percentage }}{100}\) × Net monthly income

= \(\frac{4}{100}\) × 5,200

= 0.04 × 5,200

= $208

Difference of spending in month = 780 – 208 = $572

Hence, Morales family spend $572 more on food than entertainment

Question 3.

The air conditioning in the Morales’s house is broken. The repair service estimated that the cost of repairing it is $1,040. How many months of emergency funds will the family use to fix the air conditioning?

Answer:

Net monthly income of Morales’s family = $5, 200

Percentage of budget used for emergency fund = 5%

Cost of repairing air conditioning = $1,040

Honey spent monthly on Emergency fund = \(\frac{\text { Percentage }}{100}\) × Net monthly income

= \(\frac{5}{100}\) × 5,200

= 0.05 × 5,200

= $260

Number of month for which emergency fund will be used = 2\(\frac{1040}{260}\) = 4

4 months of emergency fund will be used for repairing of air condition.

Question 4.

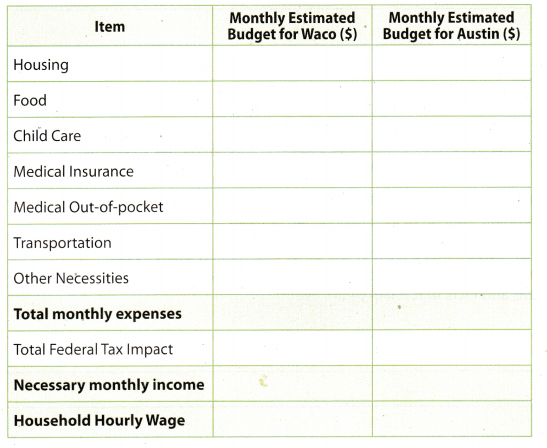

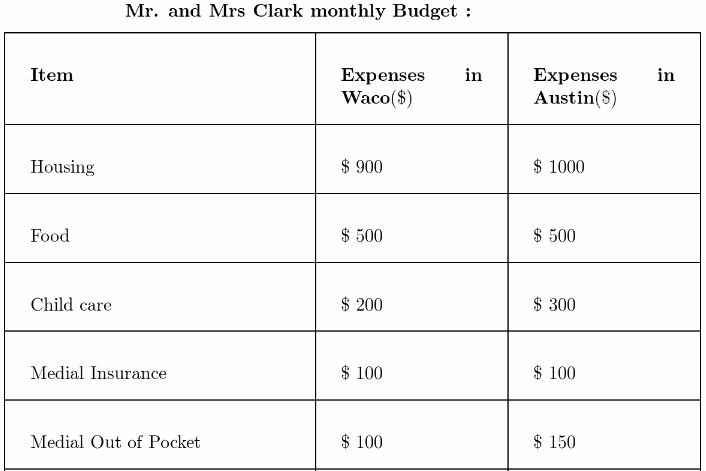

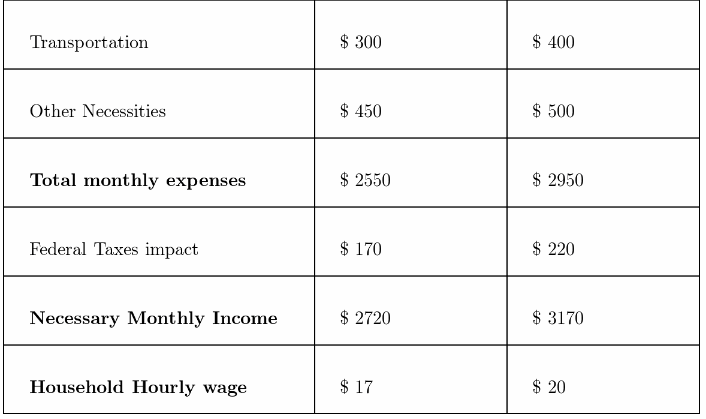

Mr. and Mrs. Clark have two children. They live in Waco, Texas. They may move to Austin to be closer to their parents. Their employers pay for 100% of one parent’s health insurance premium and 50% of the premium for other family members. Use an online family budget estimator to estimate to the nearest dollar, the following for the Clark family in Waco and in Austin.(Lesson 14.2)

Answer:

Household hourly wage are $17 and $20 respectively.

Question 5.

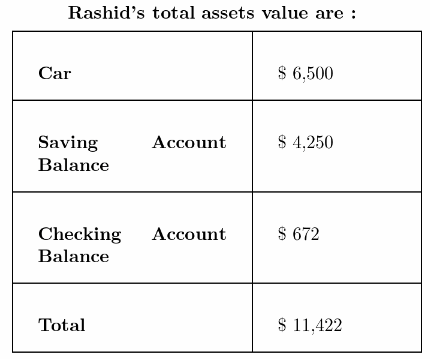

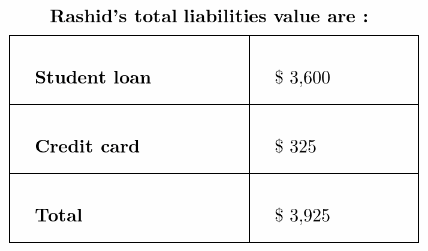

Rashid paid off his car, which is worth $6,500. He has a credit card balance of $325. He has $4250 in his savings account and $672 in his checking account. He owes $3,600 in student loans. He lives with his parents. What is Rashid’s net worth? (Lesson 14.3)

Answer:

Rashid’s net worth = Assets vaLue – Liabilities value

= 11,422 3,925

= $7,497

Hence, Rashid’s net worth is $7, 497.

Texas Go Math Grade 7 Unit 7 Performance Tasks Answer Key

Question 1.

CAREERS IN MATH Freelance Computer Programmer Andre works as a freelance computer programmer, and his laptop has stopped working. He is purchasing a new laptop, which he needs to have in 2 days in order to meet a job deadline. He lives in Massachusetts, which has a 6.25% sales tax. He is considering these three options for the purchase:

Buy it online for $1,499, pay sales tax, and pay $24 priority shipping.

Buy it in Massachusetts for $1,479.

Buy it in New Hampshire for $1,549 with no sales tax.

a. Calculate the total cost for each option. Which is the best deal?

Answer:

Determine the total cost for each option.

Online:

1,499 × 0.0623 = 93.6875 Determine the sales tax

1,499 + 93.6875 + 24 = 1, 616.6875 Determine the cost

Massachusetts:

1,479 × 0.0625 = 92.4375 Determine the sales tax

1.479 + 92.4375 = 1,571.4375 Determine the cost

Buying in New Hampshire will cost $1,549. Based on the three deals, the lowest deal is buying the laptop in New Hampshire.

The total cost for each deal, showed that the lowest deal is buying the laptop in New Hampshire.

b. List other factors that relate to the purchase that could also affect Andre’s decision.

Answer:

The factors that would affect Andre’s decision as to where to purchase a Laptop.

- The mode of transportation from Massachusetts to New Hampshire and vice-versa. If he has a car, then it is not a problem. If public transportation, the fare going to and from Massachusetts to New Hampshire.

- The availability of the Laptop in New Hampshire or in Massachusetts.

- The condition of the Laptop when it is purchased online.

The factors that would affect Andre’s decision.

Question 2.

Grant is going to purchase several large pizzas for a party. He has two options for local pizza shops as described below.

Hank’s Pizza: For every two pizzas, get a third at half price.

Antonio’s: 20% off of all orders of $40 or more.

a. Write a paragraph that describes the other information Grant needs in order to compare these options. Include both facts that relate to the pizzas and facts that relate to the event.

Answer:

First Grant needs to know how many people will come to his party. With this, he can estimate the number of pizzas

he will order. Grant also needs to know the price and the size of the Large pizza to compare the options. Also, Grant needs to consider the distance of the pizza shop to his house for the time of delivery.

The number of guests; the price and size of large pizza and distance of the pizza shop to his house.

b. Suppose large pizzas cost $13 at each shop. Compare the total cost at each shop for 3 pizzas and for 6 pizzas.

Answer:

Determine the total cost at each pizza shop.

Ordering 3 pizzas at Hank’s Pizza:

(2 × 13) + (13 ÷ 2) = 32.50

Ordering 6 pizzas at Hanks Pizza. Since the 3 pizzas would cost $32.50, multiply it by 2:

32.50 × 2 = 65

Ordering 3 pizzas at Antonio’s:

3 × 13 = 39

No discount because the total price is less than $10.

Ordering 6 pizzas at Antonio’s:

6 × 13 = 78

The cost is more than $40, there is a discount of 20%

78 × 0.20 = 15.6

78 – 15.6 = 62.4

at Hank’s Pizza (3 pizzas) = $32.50; (6 pizzas) = $65; at Antonio’s (3 pizzas) = $39; (6 pizzas) = $62.10

Texas Go Math Grade 7 Unit 7 Mixed Review Texas Test Prep Answer Key

Selected Response

Evan makes $2,800 a month and has $750 withheld as federal income tax. Use this information for 1-3.

Question 1.

How much does Evan pay for Social Security, which is 6.2% of his monthly salary?

(A) $127.10

(B) $173.60

(C) $2,626.40

(D) $2,672.90

Answer:

(B) $173.60

Net monthly income of Evan = $2, 800

Percentage of income that Evan pay for Social Security = 6.2%

Social Security payment = \(\frac{\text { Percentage }}{100}\) × Net monthly income of Evan

= \(\frac{6.2}{100}\) × 2,800

= 0.062 × 2,800

= 0.062 × 2,800

= $173.60

Question 2.

How much does Evan pay for Medicare, which is 1.45% of his monthly salary?

(A) $29.73

(B) $40.60

(C) $2,759.40

(D) $2,770.27

Answer:

(B) $40.60

Net monthly income of Evan = $2,800

Percentage of income that Evan pay for Medicare = 1.45%

Medicare payment = \(\frac{\text { Percentage }}{100}\) × Net monthly income of Evan

= \(\frac{1.45}{100}\) × 2, 800

= 0.0145 × 2, 800

= $40.60

Total deduction = $750 + $173.60 + $40.60 = 964.2

Net Pay = Gross pay – Total deduction

= $2,800 – $964.2

= $1,835.80

Question 3.

What is Evan’s net monthly pay?

(A) $1,835.80

(B) $1,876.40

(C) $2,050

(D) $2,585.80

Answer:

(A) $1,835.80

Net monthly income of Evan = $2,800

Amount withheld as Federal Income tax = $750

Amount Paid for Social Security = $173.60

Amount Paid for Medicare = $40.60

Medicare payment = \(\frac{\text { Percentage }}{100}\) × Net monthly income of Evan

= \(\frac{1.45}{100}\) ×

= 0.0145 x 2, 800

= $40.60

Total deduction = $750 + $173.60 + $40.60 = 964.2

Question 4.

Which of the following is not an example of a fixed expense?

(A) weekly martial arts lesson

(B) monthly bus pass

(C) vacation

(D) rent

Answer:

(C) vacation

Vacation expanse is not an example of Fixed expense because when we go on vacation the expenses are not strictly fixed. The expenses on vacation depends on different factor such as on our mood, place etc. So the expense amount is never fixed.

Question 5.

Bonnie deposits $180 in a savings account that earns simple interest at an annual rate of 3%. How much interest does her account earn after 10 years?

(A) $0.54

(B) $5.40

(C) $54

(D) $540

Answer:

(C) $54

Given Principal amount which is deposited in bank = $180

Rate of simple interest annually = 3%

Duration for which amount is kept in bank = 10 years

Simple interest for 10 year = \(\frac{180 \times 3 \times 10}{100}\)

= \(\frac{5400}{100}\)

= $54

Simple interest in 10 year will be $54

Question 6.

Shelby can purchase a 4-pound item from several different retailers. Which is the best buy?

(A) online for $19, plus shipping and handling costs $0.89 per pound

(B) online for $20, plus shipping and handling costs $0.59 per pound

(C) $29.95 with a $5-off coupon

(D) regularly priced for $30 on sale for 25% off

Answer:

(B) online for $20, plus shipping and handling costs $0.59 per pound

Total cost = $19 + (4 × 0.89) = $22.56

Total cost = $20 + (4 × 0.59) = $22.36

Total cost = $29.95 – $5 = $24.95

Total cost = $30 – (0.25 × 30) = $22.50

Hence, option B will be correct answer because in this case the cost of 4 pound items is least as compared to the other three options.

Question 7.

Which of the following is not an example of an expense?

(A) savings

(B) entertainment

(C) wages

(D) snacks

Answer:

(C) wages

Wages is not example of expense because it is the amount which we get after working for someone or any organisation. Wages are the source of income Whereas expenses are the amount which we give in order to buy

something or for any service we get.

Question 8.

Mr. Burr and his daughter live in Corpus Christi, Texas. Mr. Burr’s employer pays 100% of his insurance premium and 50% of the premiums for the rest of the family. His total monthly expenses according to an online family budget estimator are about $2,100. His payroll and income taxes are $257 and he gets tax credits of $245, what is his necessary monthly income?

(A) $2,088

(B) $2,817

(C) $2,112

(D) $3,827

Answer:

(C) $2,112

The family budget is $2100, the payroll and income taxes are $215 and the tax credits is $257, therefore the minimum montii1 income is $2100 + $245 – $257 = $2112, therefore C.

Question 9.

Which represents the solution for the inequality 6x – 9 < 9?

(A) x < 3 (B) x ≤ 3 (C) x > 3

(D) x ≥ 3

Answer:

(A) x < 3

Given in problem : 6x – 9 < 9

6x – 9 < 9 (Given)

6x – 9 + 9 < 9 + 9 (Adding ‘9’ on both side)

6x < 18 (Adding)

x < \(\frac{18}{6}\) (Dividing both side by ‘6’)

x < 3 (Simplifying)

Hence, option A is correct answer.

Question 10.

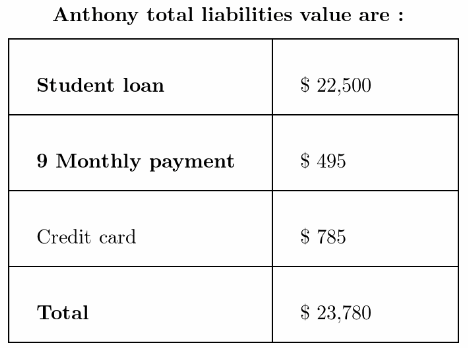

Anthony owns a home with a value of $140,000. He also owns a motorcycle worth $7,000. He has $22,500 in student loans to repay. He owes 9 monthly payments of $55 ‘each for his keyboard. He has a credit card balance of $785. He also has $3,400 in a bank account. What is Anthony’s net worth?

(A) $112,620

(B) $126,620

(C) $119,820

(D) $128,190

Answer:

(B) $126,620

Anthony’s net worth = Assets value – Liabilities value

= 150,400 – 23,780

= $126,620

Hence, option B is correct answer.

Question 11.

What is the volume of a triangular prism that has a height of 36 meters and a base with an area of 15 square meters?

(A) 180 m3

(B) 270 m3

(C) 360 m3

(D) 540 m3

Answer:

(D) 540 m3

Given base area of triangular prism = 15 metre2

Given height of triangular prism = 36 meter

Volume of triangular prism = Area of base × Height of triangular prism

= 36 × 15 m3

= 540 m3

Hence, Option D is correct answer.

Question 12.

Which of the following is an example of an asset?

(A) student loan

(B) money in a savings account

(C) credit card debt

(D) house mortgage

Answer:

(B) money in a savings account

Assets are something which we own and it has some positive cash value.

Money in a saving account will be the assets because money in our saving account is something which we own and

it has positive cash value. With this amount we can buy anything according to our need, also which will, have some positive cash value.

option B is correct answer

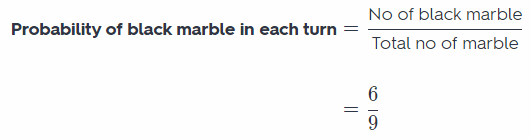

Question 13.

A bag contains 3 white marbles and 6 black marbles. You pick out a marble, record its color, and put the marble back in the bag. If you repeat this process 36 times, how many times would you expect to remove a black marble from the bag?

(A) 9

(B) 12

(C) 24

(D) 27

Answer:

(C) 24

Number of white marbles = 3

Number of black marbles = 6

Number of times for which experiment is repeated = 36

No of times in which black ball is removed = \(\frac{6}{9}\) × 36

= 6 × 4

= 24

Hence, option C is correct answer.

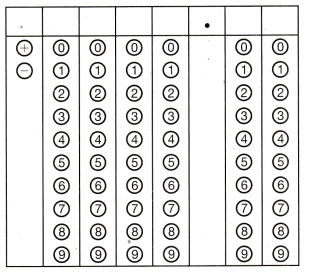

Gridded Response

Question 14.

Neelie bought a pair of shorts for $17.99 and 2 T-shirts for $6.89 each. What is the total price in dollars including an 8% sales tax?

Answer:

Cost of a pair of shorts = $17.99

Cost of 2 T-shirts = 2 × $6.89 = $13.78

Cost of shorts and T-shirts = 17.99 + 13.78 = $31.77

Given rate of saLes tax = 8%

Tota price including sates tax = 31.77 × (1 + 0.08)

= 31.77 × 1.08

= $34.31

Hence, the total cost including sales tax is $34.31

Hot Tip!

Underline key words given in the test question so you know for certain what the question is asking.

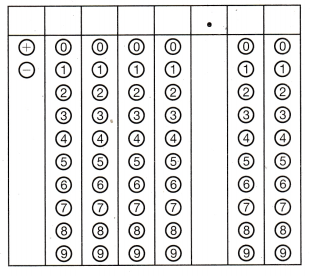

Question 15.

Len deposited $400 into an account earning interest at an annual rate of 2.5% compounded annually. What is the amount of interest in dollars that the account will earn after 5 years?

Answer:

Given Principal amount which is deposited in bank = $400

Rate of compound interest annually = 2.5%

Duration for which amount is kept in bank = 5 years

Total amount in account after 5 year = 400 × (1 + 0.025)5

= 400 × (1.025)5

= 400 × 1.131

= $452.56

Hence, total amount after 5 year will be $452.56.

Texas Go Math Grade 7 Unit 7 Vocabulary Preview Answer Key

Use the puzzle to preview key vocabulary from this unit. Unscramble the circled letters within found words to answer the riddle at the bottom of the page.

- The things you own that have a positive cash value. (Lesson 14.3)

- The amount of money you earn. (Lesson 14.1)

- A plan for managing your money to help you reach your financial goals. (Lesson 14.1)

- Debts you owe that have a negative cash value. (Lesson 14.3)

- Expenses that occur regularly and stay the same (2 words). (Lesson 14.1)

- The difference between assets and liabilities (2 words). (Lesson 14.3)

Question:

What did the fisherman give to the IRS?

A: His __ __ ___ __ __ __ __ ___!

Answer: