Refer to our Texas Go Math Grade 6 Answer Key Pdf to score good marks in the exams. Test yourself by practicing the problems from Texas Go Math Grade 6 Lesson 18.2 Answer Key Protecting Your Credit.

Texas Go Math Grade 6 Lesson 18.2 Answer Key Protecting Your Credit

Texas Go Math Grade 6 Lesson 18.2 Explore Activity Answer Key

Explore Activity 1

Establishing Credit History

Your credit history includes information about how well you manage your money and pay your bills. To build a positive credit history, you must first obtain a small loan or begin buying on credit, Then you must make regular payments to repay your debt.

Banks and other lenders use this information to decide whether they should loan you money for large purchases. Landlords use your credit history to decide whether or not to rent an apartment or house to you.

Raphael’s older brother has applied for a bank loan to buy a jet ski. Each statement below tells something about the brother’s credit history. Decide whether the bank would regard each statement as a positive or negative factor in deciding whether to approve the loan application.

A. Pays credit card balance monthly and on time

B. Recently lost his job and is looking for work

C. Is currently repaying student loans and a loan to start a business

D. Answered all questions on the application honestly, even those that reflected poorly on his past credit history

Explore Activity 2

Credit Reports

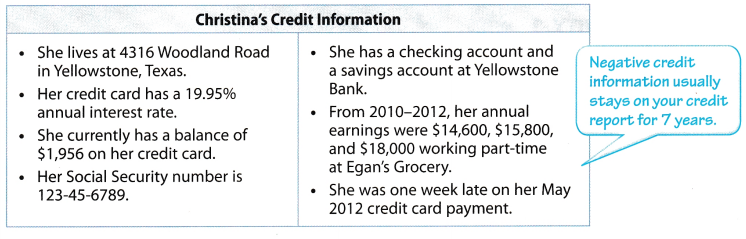

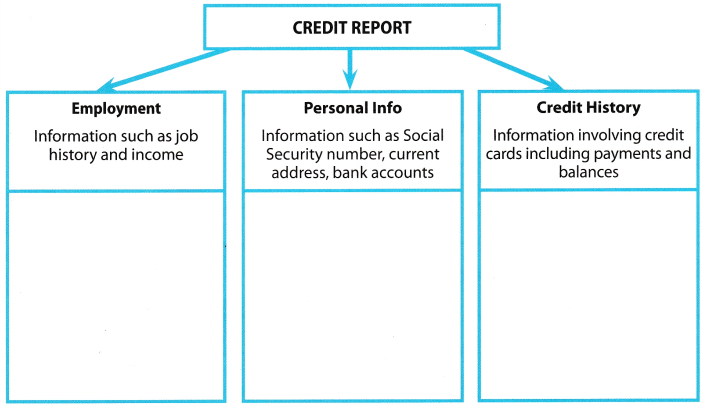

Credit reports are compiled by agencies to help lenders decide whether or not to loan money to consumers. A credit report includes a person’s credit history as well as personal information, employment background, and income.

Sort the following information about Christina into the table.

Reflect

Question 1.

Jason made several late payments on his credit card four years ago. What effect does that have on his credit report now? Explain.

Answer:

Since he made some of his credit card payments late four years ago, it will still be reflected on his credit report because all, credit information stays in the credit history for 7 years.

His previous late payments will still reflect on his credit report.

Example 1

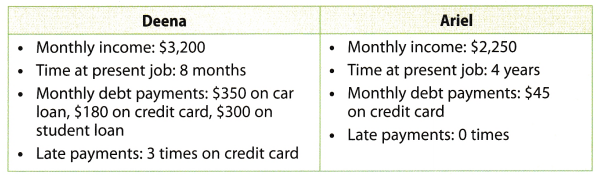

Credit histories for Deena and Ariel are given below. One received a credit score of 760, which is considered an excellent credit score by most lenders. The other received a credit score of 590, which is considered a poor credit score by many lenders. Match the person with the score.

STEP 1: Compare monthly debt with monthly income.

Deena: \(\frac{350+180+300}{3,200}=\frac{830}{3,200} \approx 25.9 \%\) Ariel: \(\frac{45}{2,250}=2 \%\)

Ariel has the lower monthly income of the two. But she spends only 2% of her income on debt repayment. Deena spends more than one-quarter of her income on debt repayment.

STEP 2: Compare other factors.

Deena has been at her job for less than a year. That and her 3 late payments will lower her score even more. Ariel has held her job for 4 years and has never missed a credit card payment.

STEP 3: Match the score with the person.

Ariel : Low debt-to-income ratio, excellent job and credit history

Deena: High debt-to-income ratio, good job history, poor credit history

Reflect

Question 2.

Which of the two women would be more likely to get a car loan? Explain.

Answer:

Based from the computation, Ariel will most likely to get a car loan because of her excellent credit historya and deb-to-income ratio.

Your Turn

Match the credit score with the credit history. Credit scores: 760,600

Question 3.

Monthly income: $1,900

Credit card payment: $48

Credit card balance: 3,857

Car loan payment: $218

Two late car loan payments

Answer:

Compare monthly debt with monthly income

= \(\frac{\$ 48+\$ 218}{\$ 1,900}\) add all the monthly debt then divide by the income

= \(\frac{\$ 266}{\$ 1,900}\) simplify

≈ 14% rate of payment out of the income

The credit score for this credit history is 600

Question 4.

Monthly income: $3,300

Credit card balance: pays full balance Monthly student loan payment: $100

Answer:

Compare monthly debt with monthly income

= \(\frac{\$ 100}{\$ 3,300}\) divide the monthly debt by the income

≈ 3% rate of payment out of the income

The credit score for this credit history is 760.

Texas Go Math Grade 6 Lesson 18.2 Guided Practice Answer Key

Question 1.

Explain why it is important to have a good credit history. (Explore Activity 1)

Answer:

It is important to have a good credit history because this information will be used by banks to decide whether to approve loans or large purchases.

Good credit history wilt help banks decide if an individual will get a high credit score.

Question 2.

List two items that could appear on a person’s credit report that might hinder the person in his or her effort to get a loan to buy a boat. (Explore Activity 2)

Answer:

The information that can affect a loan of an individual is the monthly debt payments or existing loan payments and credit card late payments.

Match the credit score with the credit history. Credit scores: 700,620 (Example 1)

Question 3.

Monthly income: $3,200. Credit card 1 payment: $151. Credit card 2 payment: $61. Car loan payment: $365. Three late credit card payments

Answer:

Compare monthly debt with monthly income.

= \(\frac{\$ 151+\$ 61+\$ 365}{\$ 3,200}\) add all the monthly debt then divide by the income

= \(\frac{\$ 577}{\$ 3,200}\) simplify

≈ 18.03% rate of payment out of the income

The credit score for this credit history is 620 because of high debt-to-income ratio and credit card late payments.

Question 4.

Monthly income: $2,800. Student loan payment: $140. Car loan payment: $276. Credit card balance: pays full balance monthly; no late payments

Answer:

Compare monthly debt with monthly income.

= \(\frac{\$ 140+\$ 276}{\$ 2,800}\) add all the monthly debt then divide by the income

= \(\frac{\$ 416}{\$ 2,800}\) simplify

≈ 14.86% rate of payment out of the income

The credit score for this credit history is 700 because it has no credit card balance and no late payments.

Essential Question Check-In

Question 5.

Angela has a credit score of 800. Describe reasons why her score might be so high.

Answer:

Angela has high credit score may be because she has an excellent job and credit history. Some of the factors that might affect her high credit score can be the low debt-to-income ratio, no late payments, and no credit card balances.

Texas Go Math Grade 6 Lesson 18.2 Independent Practice Answer Key

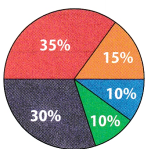

Five factors are used to calculate your credit score. The circle graph shows the relative importance of each factor. The two factors represented by 10% on the graph are (1) new credit and (2) the types of credit you use.

The other factors represented on the graph are (3) length of time you have been borrowing on credit, (4) your record of paying on time, and (5) the total amount you owe.

Question 6.

Which factor do you think is represented by the 35% sector of the graph? Explain your reasoning.

Answer:

The 35% sector shows the record of paying on time. Late payments will have a big effect on the credit score as to the duration of your delayed payments.

The part of the graph with the biggest factor to the credit score is the record of paying on time.

Question 7.

Which factor do you think is represented by the 30% sector of the graph? Explain your reasoning.

Answer:

The 30% sector shows the record of the total amount you owe the company. It also determines the responsibility of an individual in utilizing the credit card not to go beyond the credit limit allowed by the account.

Question 8.

Describe possible consequences of each of the following.

a. failing to pay your cell phone bill

Answer:

If an individual. will not be able to pay the cellphone bill, then the telephone company will temporary disable the account of the user. It will be reconnected once the user have settled the unpaid balance from his account.

b. failing to pay your credit card bill on time

Answer:

When an individual fail to pay the credit card bill on time, the credit card company will charge additional amount for late payment. It will also affect the credit score of the pay or, for which case a loan or another credit card may not be approved easily.

Question 9.

Whitney and Jonathan each take out a $15,000 loan for a new car. Each has to repay the loan in 4 years. Whitney will pay an interest rate of 3% per year. Her monthly payments will be $332.01. Because Jonathan has a lower credit score, he will have to pay an interest rate of 3.5% per year. His monthly payments will be $335.34.

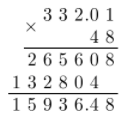

a. How much will Whitney repay the lender in 4 years?

Answer:

Determine the amount Whitney will repay the loan in 4 years.

12 × 4 = 48 months

Whitney will repay the amount of $15,936.48 in 4 years.

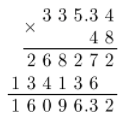

b. How much will Jonathan repay the lender in 4 years?

Answer:

Determine the amount Jonathan will repay the loan in 4 years.

12 × 4 = 48 months

Jonathan will repay the amount of $16,096.32 in 4 years.

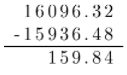

c. How much more will a $15,000 loan cost Jonathan than it will cost Whitney?

Answer:

Determine the difference of the loan of Jonathan than Whitney.

Jonathan will pay $159.84 more than Whitney.

H.O.T. Focus on Higher Order Thinking

Question 10.

Critical Thinking You have just obtained a copy of your credit report and are disappointed with your score. Describe steps you could take to raise the score.

Answer:

Identify the different factors that affected the credit score. Then, communicate with the lender or credit card company how you can negotiate the terms in paying for your outstanding balances or loans. Settle unpaid balances or lessen the terms of payment for existing loans.

Question 11.

Critical Thinking Tom Smith obtains a copy of his credit report and is certain that it contains errors. Should he (a) assume that he is wrong and do nothing, or (b) contact the company that issued the report and inform them of the errors? Explain.

Answer:

With his situation, he has to contact the company who have issued the report and clarify whatever errors that he noticed. It will help him identify the errors recorded in the report and will be able to correct such errors. He cannot just assume that he is correct or wrong unless he has clarified the report from the company. Information and clarification must come from the authorized person of the company.

Question 12.

Critical Thinking You are a bank loan officer. Elena comes to you seeking a loan. She tells you that she has a sure-fire idea for a business that simply cannot fail. She states further that the bank will not be risking a penny by granting her the loan. Do Elena’s claims encourage you or discourage you from approving the loan?

Answer:

As a bank loan officer, one must not rely only on the interview done with the customer. Instead, the proper authorities or person-in-charge must do some credit investigation. Any individual will uplift himself and will positive words just to be approved for a loan. However, there should also be physical documents or evidences that will prove such claim. In the situation, Elena is just reiterating an idea about a business but there are no proofs that the said business is existing or has been studied to be feasible. She might have misunderstood her cLaim for saying that the bank will not be at risk once she was granted a loan.